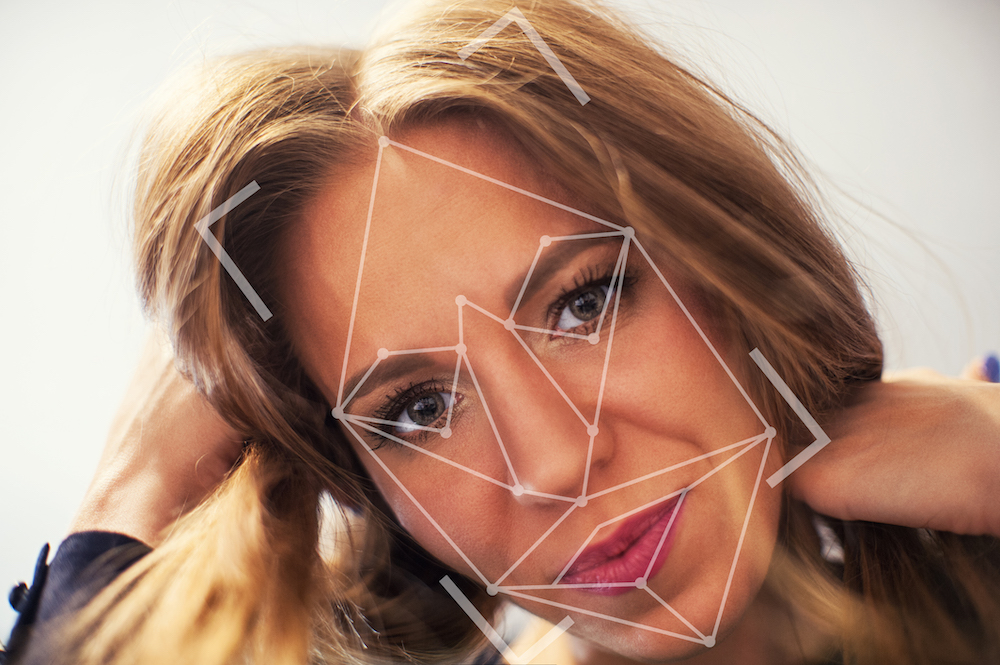

A world with very little privacy is right around the corner. Well, that is what some conspiracy theorists and sci-fi authors would have us believe. While our current reality is not this dark, trends show an increase in public security monitoring. In parallel, personal security is a growing concern. Both physical and online security relate to your digital id and facial recognition systems. These technologies intertwine and work at shaping our future in a big way.

SAFETY #1

Our interest in security is peaking, especially now that we are tightly packed into cities. Who wouldn’t appreciate everyone following the law for the sake of safety and freedom? Compromising some of your privacy seems like an acceptable trade-off when it means we all live in a better place. Even better, if our online identity can be protected too.

Digital identity verification and facial recognition systems are transformational technologies. Benefits include:

- Superior authentication model

- Near elimination of online fraud

- Create banking options for all global citizens

Let’s learn how.

LESS PRIVACY MORE SECURITY

We should be mindful we don’t risk losing basic civil liberties while on the road to more protection. What happens when government agencies and private companies make facial security monitoring ubiquitous. Advocacy groups are voicing potential pitfalls.

However, let’s examine three key benefits this tech promises to give the world. There are many more positives than three. But, we hope this will be enough for you to seek out more information before taking a position.

Relevant advice commonly communicated by a past United States President:

When written in Chinese, the word ‘crisis’ is composed of two characters – one represents danger, the other represents opportunity.

John F. Kennedy

AUTHENTICATION

A few short decades ago, biometric authentication existed only in science fiction. Now it has become a standard. Nearly all modern smart devices come with a fingerprint scanner. But high-risk services, like banks, are demanding more robust security. The solution means evolving from using fingerprints to facial authentication. Eventually, 3D face scans will be the norm.

Next-gen 3D capable mobile devices will have the advanced cameras capable of capturing required facial data, regardless of lens angle variations. Additionally, processing software will have built-in AI that can accurately compare faces images to government id photos. A system without human intervention, and so eliminating human error. The goal is to boost accuracy from 2D levels by more than 50% improvement. Sufficient enough to satisfy the most demanding online onboarding process.

STRESS

For many decades now, we have faced accepting the risks of using online services versus giving up online conveniences. No matter what option you choose, consumer stress levels have spiked. I have experienced first hand, long lines at government offices and banks in countries where the majority of customers don’t use online services because of mistrust. The experience of standing in a lengthy queue in a hot, crowded room is not a festive option.

IDENTIFY THEFT

One the other side, consumers who have trusted esteemed fortune 500 companies, have seen their electronic profile hacked and personal data stolen. In some cases, this leads to identity theft. Such victims often suffer from loss of time and money. Nothing can be more stressful than seeing your bank account drained to 0 without your knowing.

The solution may very well be letting consumers establish their digital id using facial recognition systems. This approach is becoming the preferred option to fight against electronic fraud. Robust digital identity verification solutions are becoming spoof proof by adding a liveness check.

The part of the test makes sure the person is a living human. An example of a liveness check requires the person to blink with their eyes. Reducing the billions lost every year from online identity fraud will help reduce service fees and enable those previously disenfranchised.

DEMOCRATIZING FINANCIAL SERVICES

So many new people are left out of our modern economy because they don’t have a valid bank acct. It is a major economic disadvantage to developing nations as a whole and goes beyond individual suffering. Trust is at the heart of this issue. What can be done to help?

Many leaders in the financial industry have been trying to democratize banking and evolve past the original model of servicing primarily the wealthier class. Digital ID and facial authentication offer us a great chance to finally achieve these lofty goals.

Lines of trust can now form because of 2 main things. More people have smartphones than ever before. Facial authentication is currently available on Android and promises to get even better soon. This means more customers will more likely trust companies to keep their data, identity, and money safe. Vice-Versa, the banks feel secure to electronically onboard many new customers because of the security levels embedded in the latest online technology.

Quote from Google:

“If the face unlock sensors and algorithms recognize you, the phone will open as you pick it up, all in one motion. Better yet, face unlock works in almost any orientation—even if you’re holding it upside down—and you can use it for secure payments and app authentication too.”

GLASS HALF FULL

Some people are naturally skeptical, and that’s okay because it’s normal. However, we can not deny the trend that more people are doing business online. A growing number of people are choosing to trust one another. Even while never meeting in person. That demonstrates how digital ID and facial recognition systems are shaping our future.

Very soon, we will start to see global governments and financial conglomerates embrace facial authentication and digital id verification. Along with AI assisted security and liveness detection protocols, online financial services will thrive. Consumers will benefit from unprecedented protection against ID fraud. It is an exciting time, as the promise of high tech biometrics is just starting to deliver.

Talk with Digital Identity Verification Experts

Discuss your ideas, questions, and concerns. Get answers specific to your needs.